How to File Wyoming LLC Articles of Organization

Learn how to file Wyoming LLC Articles of

Organization, Processing Time and annual complainces.

Let Buykii handle the work for you — $0 + state fee

Buykii makes starting your Wyoming LLC simple.

We’ll take care of all the official

How to File Wyoming LLC Articles of Organization

Learn how to file Wyoming LLC Articles of Organization, Processing Time and annual complainces.

Buykii does the work — $0 + state fee

Starting your LLC is easy with Buykii. We handle all the required paperwork so you can focus on your business. Just pay the official Wyoming state fee.

Register Your LLC Now

Filing Wyoming Articles of Organization

Filing the Articles of Organization is the official step to form your Wyoming LLC with the Wyoming Secretary of State. This legal document officially registers your business and includes key details like your LLC name, registered agent, and principal office address.

How to File Wyoming Articles of Organization

You can file your Wyoming Articles of Organization in two ways — online or by mail, depending on your preference.

- File online (fastest) The fastest way to form your LLC is to file online through the Wyoming Secretary of State’s online portal.

- Online convenience fee: $100

- State filing fee $3.75 may apply

- File by mail: If you prefer paper filing, you can submit your Articles of Organization by mail to the state department. Include:

- The completed Articles of Organization form

- A Consent to Appointment by Registered Agent form

- A $100 filing fee (payable to the Wyoming Secretary of State).

Mail to:

Wyoming Secretary of State

Herschler Building East, Suite 101

122 W 25th Street

Cheyenne, WY 82002-0020

Let Buykii Handle All the Paperwork for You

Fast and Free

Form your LLC Now Fast and Free

How Long Does It Take to Register an LLC in Wyoming?

The Wyoming LLC approval time depends on how you file your Articles of Organization with the Wyoming Secretary of State.

Here’s a quick breakdown of the current Wyoming LLC processing time.

The typical approval time depends on your filing method:

| Filing Method | Processing Time |

|---|---|

| Online Filing | Approved immediately after payment |

| By Mail | Around 10–15 business days (depending on state workload) |

Certain Wyoming LLC Names Must Be Filed by Mail

Wyoming has strict name approval rules. If your chosen LLC name includes restricted words (like bank, trust, university, etc.), or requires additional verification, you cannot file online and must submit your Articles of Organization by mail instead.

Make sure your business name is compliant before filing. You can read our full guide here → How to Choose the Right Wyoming LLC Name.

What Are the Fees Associated with Wyoming LLC Registration?

Before forming your Wyoming LLC, it’s helpful to know the total cost to register and maintain your business. While the state filing fee is the main expense, there are a few other optional costs depending on your situation.

| Expense Type | Estimated Cost | With Buykii |

|---|---|---|

| State filing fee | $100 (one-time) | Included in our filing service |

| Registered agent service | $120–$199/year | $29/year |

| Virtual business address | $30–$120/month | Free |

These are the main costs associated with forming your LLC. Actual totals may vary depending on the services you select.

Wyoming LLC Annual Compliance

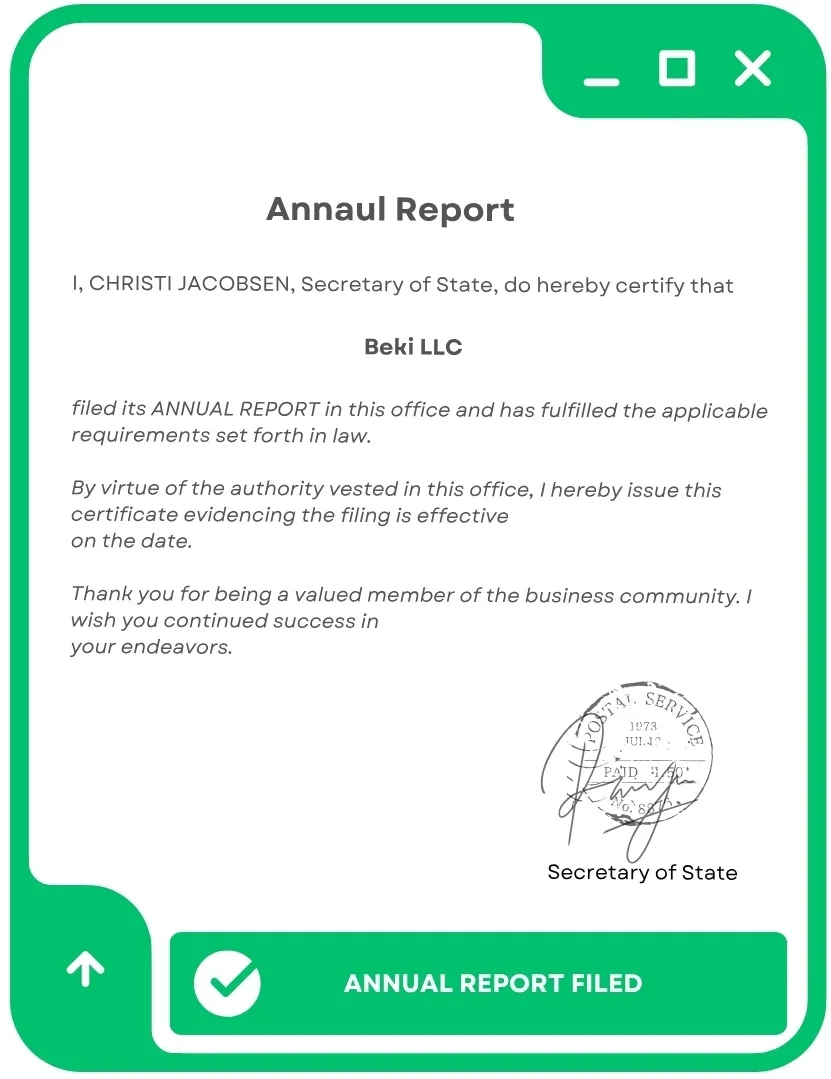

After you form your Wyoming LLC, you must keep it active by meeting state compliance requirements. The main ongoing obligation for all LLCs in Wyoming is filing an Annual Report with the Wyoming Secretary of State.

File annual report filing and stay compliant all year round.

File Annual Report

What Is the Wyoming LLC Annual Report?

The Annual Report is a mandatory filing required under W.S. §17-29-209. Its purpose is to update or confirm your LLC’s information with the state each year including your business address, registered agent, and ownership details.

Even if nothing has changed in your LLC, you still need to submit this report to keep your business in good standing.

Wyoming LLC Annual Report Filing

All Wyoming LLCs must file their Annual Report with the Secretary of State’s Business Division.

This filing keeps your company compliant and prevents it from being administratively dissolved.

The Wyoming LLC annual report fee depends on the value of assets your business owns within the state:

| Wyoming Asset Value | Filing Fee / License Tax |

|---|---|

| $300,000 or less | $60 minimum fee |

| More than $300,000 | Multiply total value × 0.0002 |

Example:

If your Wyoming business assets are worth $400,000

$400,000 × 0.0002 = $80 annual report fee

Most small LLCs only pay the $60 minimum.

How Much Is the Wyoming Annual Report Fee?

The Wyoming LLC annual report filing fee is usually $62, which includes a small electronic payment charge.

This fee is paid to the Wyoming Secretary of State each year to maintain your LLC’s active status.

When Is the Wyoming Annual Report Due?

Your Wyoming LLC annual report is due on or before the first day of your LLC’s anniversary month — the month your LLC was originally formed.

You can file up to 90 days before your due date.

| Annual Report | Details |

|---|---|

| Due date | On or before the 1st day of your LLC’s anniversary month |

| Filing fee | $62 (includes e-filing charge) | How to file | Online or by mail |

How Long Does It Take to File the Annual Report?

Online filing: Processed immediately upon payment

Mail filing: Takes about 3–5 business days

Wyoming LLC Annual Repot Late Filing Penalties

If you fail to file your Wyoming LLC annual report by the due date, the state gives you a 60-day grace period.

After that, your LLC may be marked inactive and administratively dissolved — meaning your company can no longer legally operate in Wyoming.

Can I Update My Business Information in the Annual Report?

Yes while filing your Wyoming annual report, you can update:

- Your LLC mailing or principal address

- Your registered agent information

However, you cannot change your LLC name in the annual report. Name changes require a separate state filing.

Wyoming Secretary of State Contact Information

Business Division

Herschler Building East, Suite 101

122 W. 25th Street, Cheyenne, WY 82002-0020

Phone: (307) 777-7311

Hours: Monday through Friday, 8:00 AM – 5:00 PM (Eastern Time)

Email: Business@wyo.gov

Compliance Division

Herschler Building East, Suite 100

122 W. 25th Street, Cheyenne, WY 82002-0020

Phone: (307) 777-7370

Hours: Monday through Friday, 8:00 AM – 5:00 PM (Eastern Time)

Email: Compliance@wyo.gov