Get Your Federal Employer Identification Number

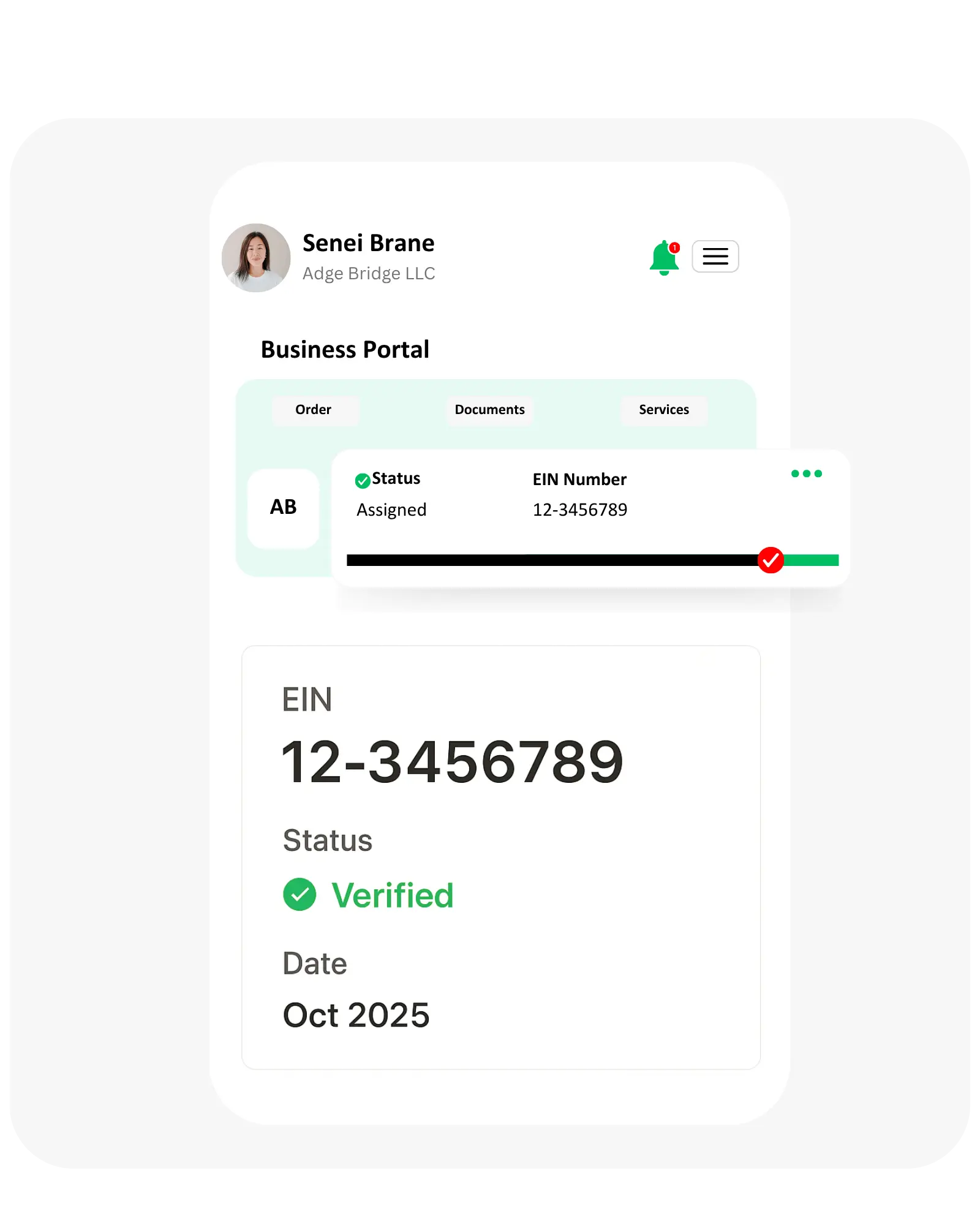

Get your EIN fast with Buykii – delivered within one business day.

Get Your Federal Employer Identification Number

Get your EIN fast with Buykii – delivered within one business day.

Get Your EIN Number Quickly!

Register your EIN hassle-free and start your business legally in the USA. Fast and reliable service.

- EIN application filed with IRS

- Quick Processing Time

- No Hidden Fees

- Get your EIN within 1 day

Choose Country of Citizenship

Why Choose Buykii For EIN Number Service?

How Our EIN Service Works

Provide Your Information

Fill out our secure online form with your business details.

We Handle Filing

Our experts submit your EIN application accurately.

Receive Your EIN

Get your EIN quickly and start your business operations.

Frequently Asked Questions

If you’re a U.S. citizen, you’ll usually get your EIN within 1 business day. For non-U.S. residents, we offer express processing and usually deliver the EIN in 2 to 3 business days. Without our help, it can take 4 to 6 weeks (or even longer) when applying directly through the IRS. We make the process faster and hassle-free for you.

Yes, you can. If you're a U.S. citizen, you’ll normally use your SSN to get an EIN. But if you don’t want to share your SSN or you're not a U.S. citizen, no worries — we file your EIN as a non-U.S. resident application, and no SSN is required.

We also provide affordable compliance services such as virtual address and registered agent services at significantly lower annual costs compared to other providers. Our goal is to make business formation and ongoing compliance accessible, efficient, and budget-friendly for startups and small business owners worldwide.

Not at all! You just need to fill out our online form with your business details — we’ll handle everything else, including preparing and submitting the IRS paperwork to get your EIN.

What is an EIN Number?

An EIN (Employer Identification Number) is a unique number assigned by the IRS (Internal Revenue Service) to businesses for tax purposes. Think of it like a Social Security Number for your business. Whether you're running a small business, a corporation, or a nonprofit, you'll need an EIN for things like paying taxes, hiring employees, or even opening a business bank account.

Simply put, an EIN is an official number used to identify your business in the eyes of the IRS, and it's essential for any company that plans to operate legally and pay taxes.

Is a Tax ID Number the Same as an EIN?

Yes, a Tax ID number and an EIN are the same thing. Many people use the term "Tax ID" as a general name for any number used to identify a business, but in most cases, it refers to the EIN. It’s your official business ID number used for tax reporting and identification with the IRS.

Why Do You Need an EIN Number?

An EIN number is crucial for any business that plans to have employees, pay federal taxes, or even establish credit. You need it to:

File Business Taxes: It’s used to file tax returns for your business.

Hire Employees: If you're going to hire anyone, an EIN is required.

Apply for Business Loans: Lenders will ask for your EIN when you apply for financing.

Open a Business Bank Account: You’ll need an EIN to open an account in your business's name.

In short, without an EIN, your business won’t be able to function properly from a legal or financial standpoint.

EIN vs. SSN vs. ITIN – What's the Difference?

When it comes to identifying yourself or your business with the IRS, there are a few different numbers to keep track of: EIN, SSN, and ITIN. Let’s break down what each one is, and how they’re different from each other:

EIN (Employer Identification Number): This is the number you need for your business. If you’re a business owner or plan to hire employees, you’ll need an EIN number to identify your business with the IRS. It's like a Social Security Number for your business.

SSN (Social Security Number): This is the number assigned to individuals for personal tax purposes. If you're an employee or a sole proprietor, your SSN is used to report your personal income taxes. Unlike an EIN, an SSN is for individual use, not for business.

ITIN (Individual Taxpayer Identification Number): If you are a foreign national or not eligible for a Social Security Number, you can apply for an ITIN. It's specifically for people who need to pay taxes but don’t have an SSN.

In summary, while an EIN is for businesses, an SSN is for individuals, and an ITIN is for individuals who can’t get an SSN but still need to file taxes.

Common Mistakes to Avoid When Applying for EIN

Applying for an EIN number is a straightforward process, but it’s easy to make a few mistakes along the way. Here are some of the most common ones to avoid:

1. Incorrect Business Name or Structure: Make sure that the name and business structure you provide match your legal registration. If your business is a LLC, Corporation, or Sole Proprietorship, it must be indicated clearly.

2. Not Checking Eligibility First: Before applying, ensure that you actually need an EIN number. If you're a sole proprietor with no employees, you may not need one. But if you’re hiring, filing taxes, or starting a corporation, you’ll definitely need an EIN.

3. Applying Multiple Times: You only need to apply for an EIN number once. If you apply more than once, you risk creating confusion or even getting multiple numbers, which can complicate your records.